About

EV Market

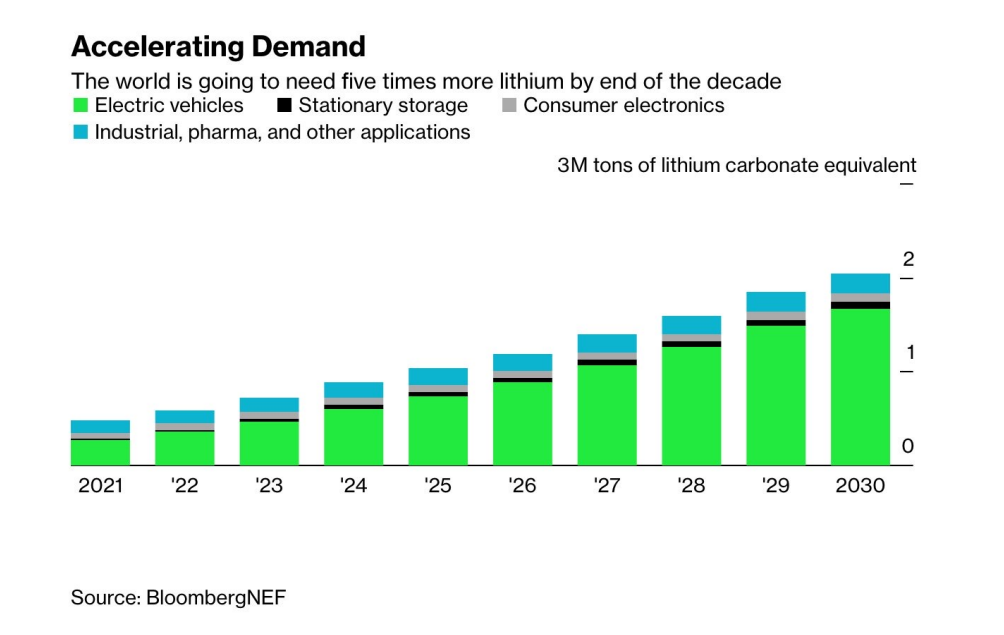

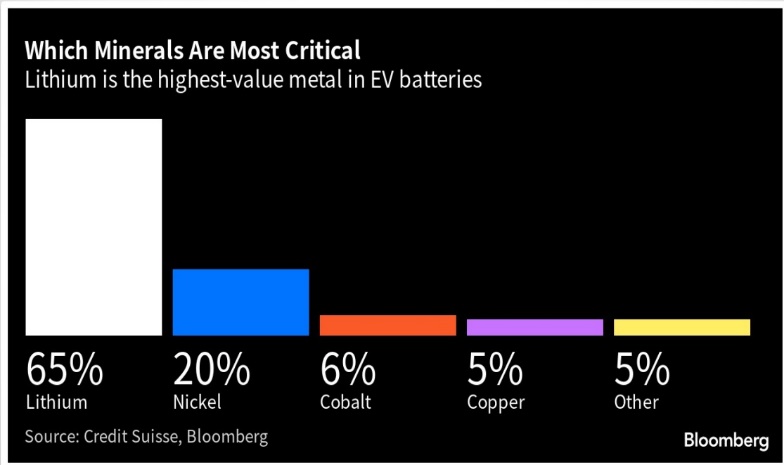

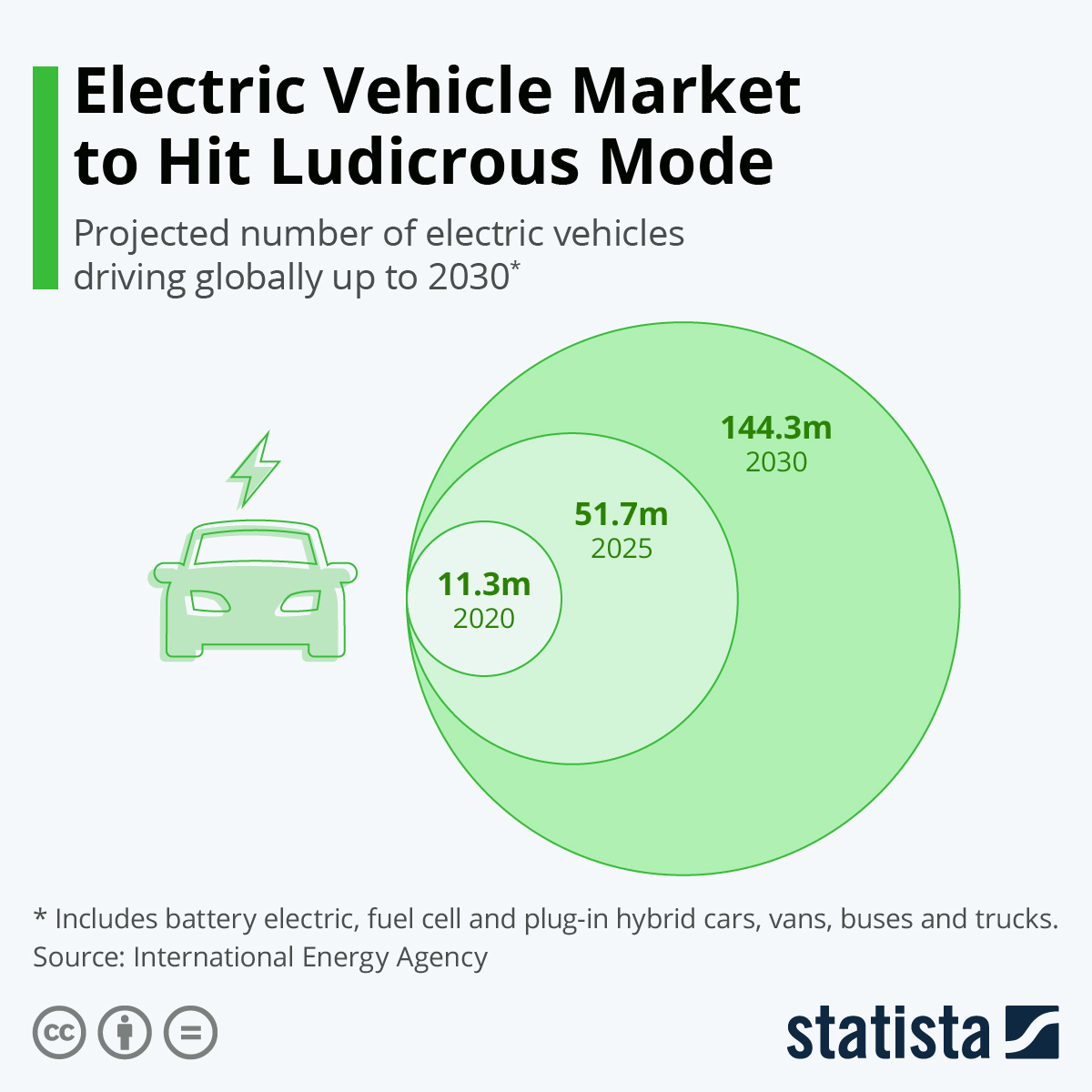

Although lithium has multiple industrial and consumer electronics applications, the most prominent application is battery production. Electric car sales are expected to continue strongly through 2023. The Internal Energy Association’s (“IEA”) annual “Global Vehicle Electric Outlook” shows that more than 10 million electric cars were sold worldwide in 2022 and that sales grew by another 35% in 2023 reaching 14 million. The majority of electric car sales to date are mainly concentrated in China, Europe and the United States, with China overwhelmingly the global leader making up 60% of electric car sales. The IEA estimates that global sales of all EVs on the road is expected to rise to over 140 million.

Global Electric Vehicle Sales Projection

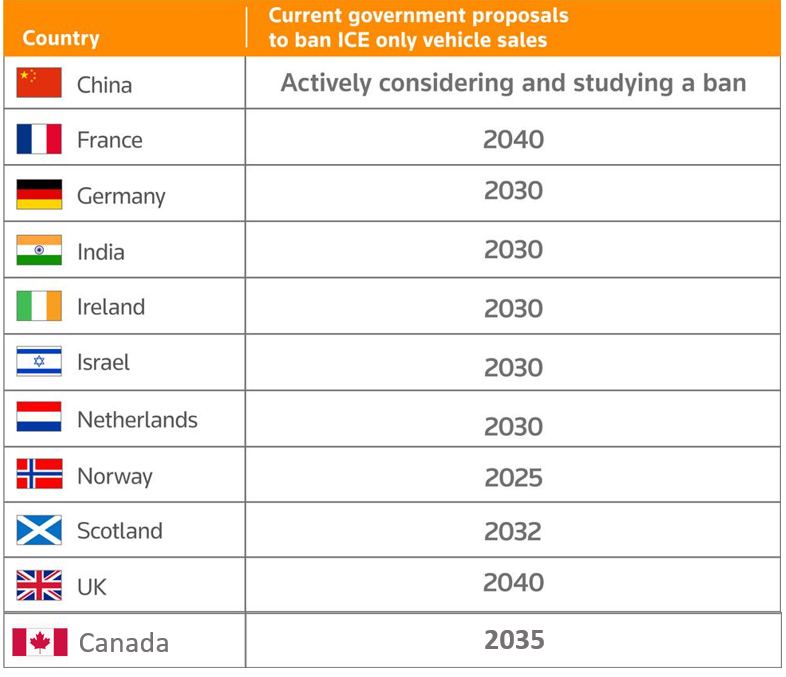

Future lithium demand is heavily linked to future EV production. Countries around the world have already formulated plans to support this change, as shown in the tables below. Government policies, new regulations and steadily increasing consumer adoption, as evidenced by a wider availability of EV models being produced by original equipment manufacturers, or OEMs, are all expected to be significant drivers in increasing EV sales. Several countries have also announced their intentions to phase out and eventually replace internal combustion engines, or ICE (internal combustion engines), vehicles with EV models. Countries such as France, Norway, and the UK have all set dates for these bans, with Norway’s being the most aggressive, as all new car sales in Norway must be zero emissions (battery EV or fuel cell) by 20251.

The Inflation Reduction Act signed into law by U.S. President Joe Biden in August 2022 has several provisions that has helped stimulate demand for EVs and motivate producers to shift their battery supply chain to North America. The new law extends availability of the $7,500 credit on the purchase of new EVs and eliminates the cap on the number of cars that can qualify. The new law also provides that, starting January 1, 2024, to be eligible, a vehicle must not only be built in North America, but its battery must be comprised of at least 40 percent of materials sourced in North America or a U.S. trading partner. Each year that percentage rises by 10 percent until by 2027 to 80 percent of the battery materials2. Also, come Jan 01/24, the way to claim the tax credit changed, converting it from a post-tax filing to an instant rebate, being able to claim the $7,500 at the point of purchase at the dealership level. As a result, it is anticipated that will only increase the demand for lithium from North American sources.

The Inflation Reduction Act should be a strong motivator for producers of lithium hydroxide and other lithium products to source their lithium ore domestically in North America. This should in-turn ultimately increase local demand for lithium, and Foremost is perfectly located to capitalize on these market conditions.