About

URANIUM MARKET

Supply and Demand

The global clean energy transition has increased the need for alternative fuel sources and nuclear power has emerged as a crucial component to meet the demand for a green economy. The demand for uranium may be driven in part by the desire to phase out dependence on fossil fuels; however, other drivers such as geopolitical events, fluctuating prices, mine closures and/or disruptions, and the COVID-19 pandemic have all contributed to a reduction in the global supply of uranium. The resulting underinvestment in uranium mining operations over the last decade has contributed to structural deficit between global production and uranium requirements. Adding to this, uranium producers, developers, and physical uranium holding companies have continued to buy physical uranium putting a further strain on the uranium supply.

As the world seeks to transition to clean energy, one fact remains clear, nuclear energy has the lowest power generation carbon footprint when compared to any other source.

Source: U.S. Department of Energy

Nuclear energy is simply the most reliable option for carbon-free baseload electricity generation. This was acknowledged at the 2023 United Nations Climate Change Conference, or Conference of the Parties of the UNFCCC (more commonly known as COP 28), where a total of 22 countries agreed to target tripling nuclear capacity by 2050 as key component of their energy security and affordability strategy.

Global clean energy commitment have seen nuclear power programs continue to expand, with 440 operating reactors in 31 countries and an additional 60 Small Module Reactors or “SMR” are under construction in 18 countries. The total uranium requirements to supply these reactors is estimated to be more than 500 million pounds by 2030, which represents an increase of 28%. Demand is expected to increase with predicted growth to over 51% by 2040 (the World Nuclear Association’s Nuclear Fuel Report, 2023). Despite the expected growth one thing is evident, without new uranium making its way to market, demand will outstrip supply over the next upcoming decade.

Small Modular Reactors

Nuclear power has a crucial role to play on the path to net zero. Traditional nuclear plants, however, can be costly, resource-intensive, and take up to 12 years to come online. Small modular reactors (SMR) offer a possible solution. Small modular reactors (SMRs) are advanced nuclear reactors that have a power capacity of up to 300 MW(e) per unit, which is about one-third of the generating capacity of traditional nuclear power reactors.2

Figure 1. Small Module Reactor Illustration

Some of the benefits SMR’s offer include:

1. Lower Costs

- SMRs require a lower upfront capital investment due to their compact size. SMRs can also match the per-unit electricity costs of traditional reactors due to various economic efficiencies related to their modular design, including design simplification, factory fabrication, and potential for regulatory harmonization.

2. Quicker Deployment

- Traditional nuclear plants can take up to 12 years to become operational. This is primarily due to their site-specific designs and substantial on-site labor involved in construction. SMRs, on the other hand, are largely manufactured in factories and are location-independent, which minimizes on-site labor and expedites deployment timelines to as little as three years. This means they can be deployed relatively quickly to provide emissions-free electricity to the grid, supporting growing electricity needs.

3. Siting Flexibility and Land Efficiency

- SMRs have greater siting flexibility compared to traditional reactors due to their smaller size and modular design. In addition, they can utilize land more effectively than traditional reactors, yielding a higher output of electrical energy per unit of land area. Given their flexibility, SMRs are also suitable for installation on decommissioned coal power plant sites, which can support the transition to clean electricity while utilizing existing transmission infrastructure.

4. Safety

- SMRs have simpler designs, use passive cooling systems, and require lower power and operating pressure, making them inherently safer to operate than traditional reactors. They also have different refueling needs compared to traditional plants, needing refueling every 3–7 years instead of the 1–2 years typical for large plants. This minimizes the transportation and

2 https://www.iaea.org/newscenter/news/what-are-small-modular-reactors-smrs

Government Policy

Government Policy is the biggest driver in creating a fundamental change to the nuclear global markets. Governments around the globe are actively pursuing strategies that prioritize energy independence and ethical supply as a key indicator for national security interests. In May 2024,the U.S. established the “Prohibiting Russian Uranium Imports Act”, banning its largest foreign supplier of uranium of importing enriched uranium produced in Russia or by Russian entities. Furthermore, in July 2024, the “ADVANCE Act” was established by the U.S., designed to strengthen the United States’ energy security, as well as expanding nuclear power as a clean, reliable power source

Niger accounted for about 5% of global uranium production and about 25% of European Union supply. The new government in power, a result of 2023 Niger coup, demanded that the U.S. and France vacate the country,1 underscoring jurisdictional perils when dealing with countries facing political unrest and underscoring the need to secure supply from areas of low geopolitical risk.

Geopolitical Events Affecting the Uranium Market

| DATE | EVENT 3 |

| December 4, 2020 | US Senate committee approves uranium reserve bill |

| December 16, 2022 | First contracts awarded for US strategic uranium reserve |

| March 6, 2023 | Nuclear power revival reaches Japan, home of the last meltdown |

| November 15, 2023 | Kazatomprom signs long-term uranium supply contract with China |

| December 10, 2023 | China uranium grab poses threat to western energy supply, warns Yellow Cake Plc. |

| December 27, 2023 | Japan lifts operational ban on world's biggest nuclear plant |

| January 9, 2024 | DOE announces next steps to build domestic uranium supply for advanced nuclear reactors as part of President Biden's Investing in America Agena. |

| April 30, 2024 | US Senate approves bill to ban Russian uranium imports |

| May 27, 2024 | Russia will build Central Asia's first nuclear power plant in an agreement with Uzbekistan |

| May 29, 2024 | Hungary's government signs deal with Belarus to help build nuclear reactor |

| August 23, 2024 | Kazatomprom, the world's largest uranium producer, announces that the production volume for its mining operations will be approximately 20% below levels stipulated in its agreements |

| September 20, 2024 | Constellation announces plan to restart Three Mile Island Nuclear Plant with Microsoft entering into 20-year power purchase agreement |

3 Source: FactSets Insights, May 2024

Uranium Drivers – Electricity

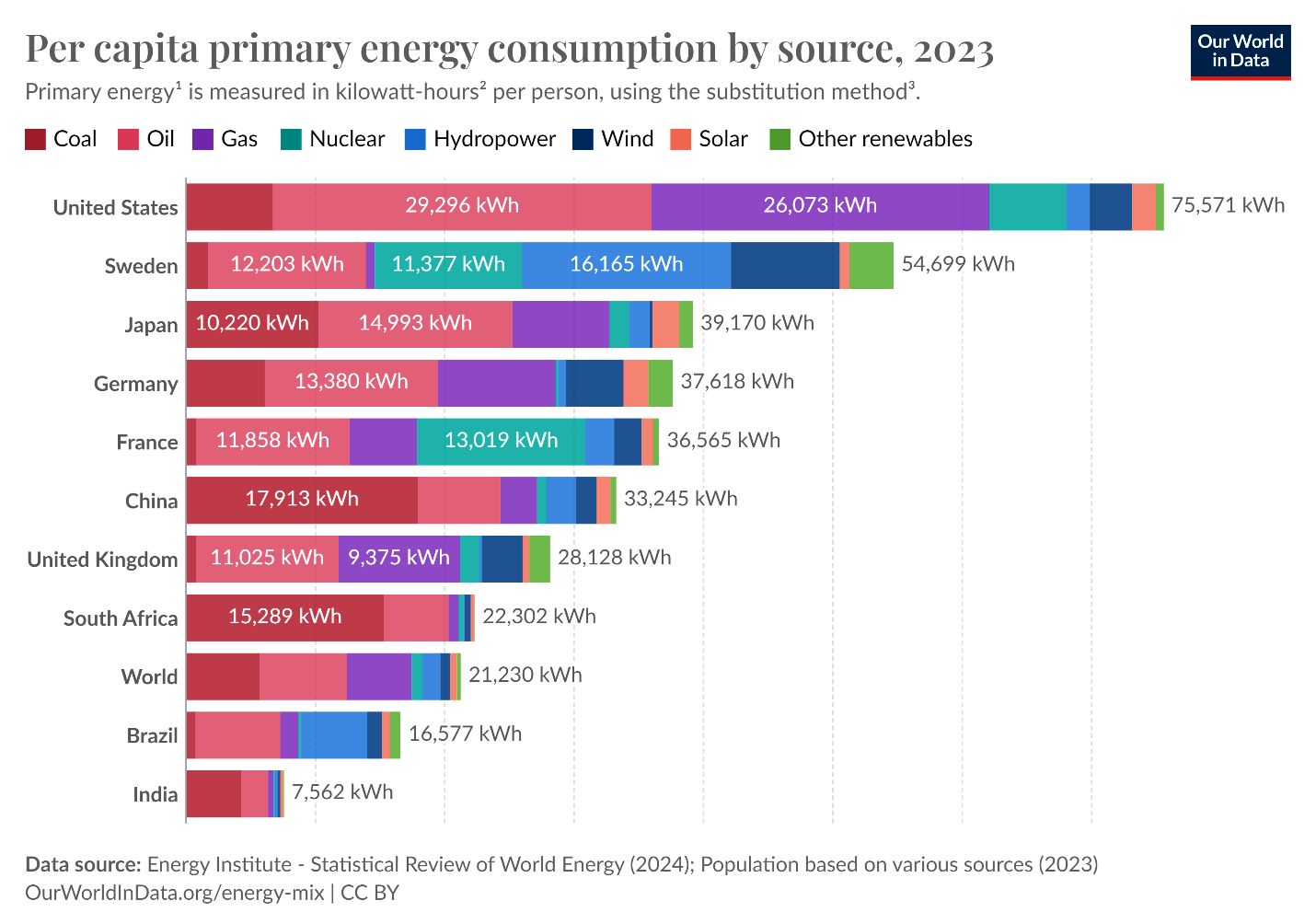

The uranium market is currently being driven, in part, by a macro demand for more electricity generation and a push to decarbonize electrical grids. According to the International Energy Agency (“IEA”), Canada’s electricity generation is over 80% renewable sources and nuclear, while China and Australia’s electricity generation is over 75% coal, oil and natural gas.

Table 1. IEA’s Global Energy Consumption by Source, per Country

According to the IEA, global electricity demand is expected to rise at a rate of 3.4% annually over the next three years as countries try and meet their net zero emissions and decarbonization targets. The gains will be primarily driven by an improving economic outlook, contributing to faster electricity demand growth in advanced and emerging economies.

Electricity consumption from data centres, artificial intelligence (AI) and the cryptocurrency sector could double by 2026. Data centres are significant drivers of growth in electricity demand in many regions. After globally consuming an estimated 460 terawatt-hours (TWh) in 2022, data centres’ total electricity consumption could reach more than 1 000 TWh in 2026.

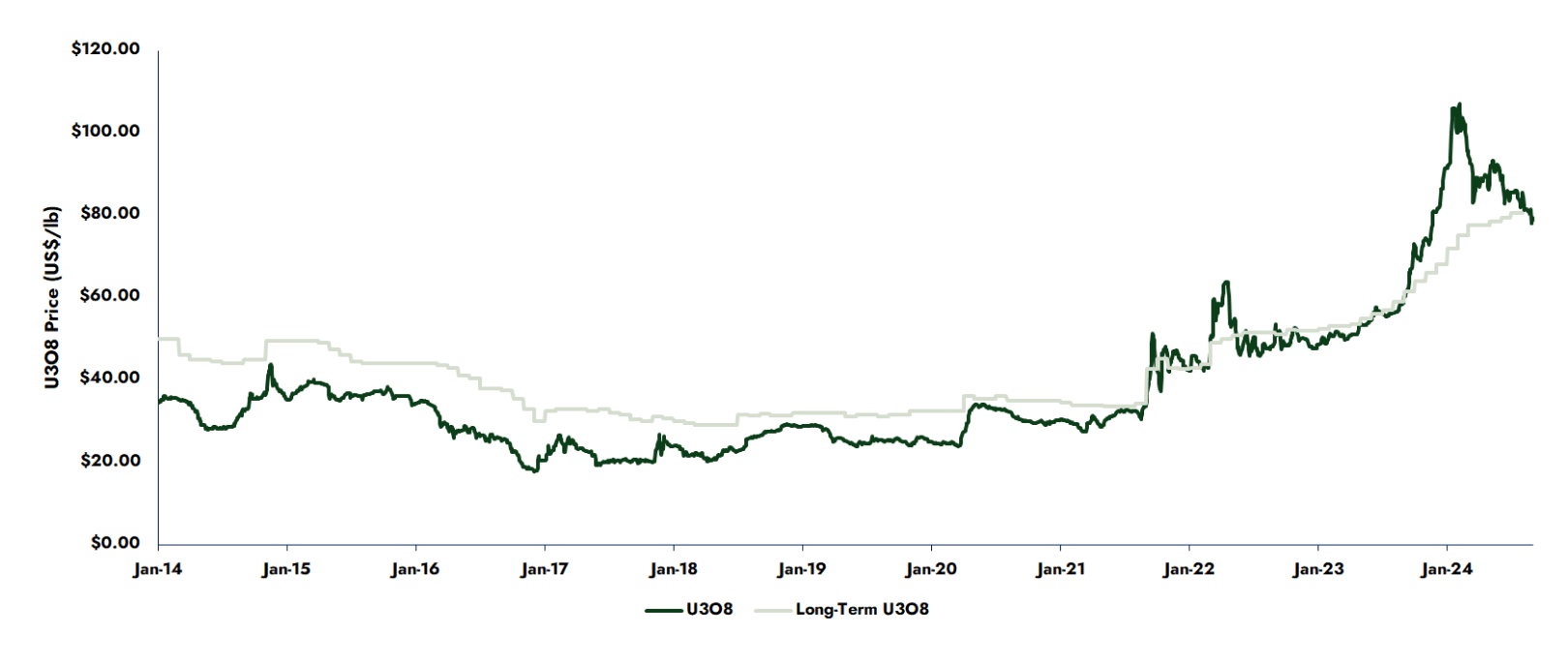

Uranium Pricing

Over the past few years global uranium market fundamentals have improved as the market began a transition from being an inventory driven market to a production driven one. While the spot market bottomed out in November 2016 at approxamitely $17.75 per pound U3O8, it has since rebounded , reaching $107.00 per pound U3O8 on February 2, 2024.

Expected realized uranium price sensitivity under various spot price assumptions at June 30, 2024 are in the table below

| Spot Prices ($US/lb U3O8) |

$20 | $40 | $60 | $80 | $100 | $120 | $140 |

| 2024 | 49 | 52 | 55 | 57 | 58 | 59 | 59 |

| 2025 | 39 | 44 | 54 | 61 | 64 | 65 | 65 |

| 2026 | 42 | 44 | 56 | 67 | 69 | 70 | 72 |

| 2027 | 43 | 45 | 58 | 69 | 73 | 74 | 76 |

| 2028 | 46 | 49 | 58 | 70 | 75 | 77 | 78 |

Table 1. (Rounded to the nearest $1.00. Table information sourced from Cameco)

Government policies, supply/demand issues, and the global desire for electrification continue to influence and drive the global energy mix. A renewed focus on nuclear power to provide energy security has become widespread. It seems conclusive that the world will require increased uranium exploration and development in the years to come.

URANIUM PRICE HISTORY1

Sources: Numerco, Cameco Corp.

4 As of August 30, 2024.

4 https://payneinstitute.mines.edu/niger-uranium-and-the-coup-detat/